Kelly Betting

Introduction

J.L.Kelly, in his seminal paper A New Interpretation of Information Rate (Bell System Technical Journal, 35, 917-926 see below) asked the interesting question: how much of my bankroll should I stake on a bet if the odds are in my favor? This is the same question that a business owner, investor, or speculator has to ask themself: what proportion of my capital should I stake on a risky venture?

The Kelly calculator is one of our most popular bet calculators, because it makes a complex mathematical equation easy to understand. This sports betting calculator works out your ideal stake for. Betting less than the Kelly amount corrects for this. The other is that the Kelly formula leads to extreme volatility, and you should underbet to limit the chance of being badly down for unacceptably long stretches. It is true that gamblers often overestimate their. And payo per bet do not change, and thus, from an intuitive stand-point, it would make sense that an optimal solution would bet the same fraction, f, of your money for every trial. The Kelly Criterion follows from this intuition (in order to allow for this type of frac-tional betting, we. Because the Kelly Criterion seeks to calculate the optimum stake for any value bet so as to maximise that value as well as maximise the growth of your betting bankroll.

Kelly did not, of course, use those precise words — the paper being written in terms of an imaginary scenario involving bookies, noisy telephone lines, and wiretaps so that it could be published by the prestigious Bell System Technical journal.

According to the Kelly criterion your optimal bet is about 5.71% of your capital, or $57.00. On 40.0% of similar occasions, you would expect to gain $99.75 in addition to your stake of $57.00 being returned. But on those occasions when you lose, you will lose your stake of $57.00. Your fortune will grow, on average, by about 0.28% on each bet.

Assuming that your criterion is the same as Kelly's criterion — maximizing the long term growth rate of your fortune — the answer Kelly gives is to stake the fraction of your gambling or investment bankroll which exactly equals your advantage. The form below allows you to determine what that amount is.

Disclaimer

- The Kelly Strategy Bet Calculator is intended for interest only.

- We don't recommend that you gamble.

- We don't recommend that you place any bets based upon the results displayed here.

- We don't guarantee the results.

- Use entirely at your own risk.

Kelly Strategy Bet Calculator

Results

- The odds are in your favor, but read the following carefully:

- According to the Kelly criterion your optimal bet is about 5.71% of your capital, or $57.00.

- On 40.0% of similar occasions, you would expect to gain $99.75 in addition to your stake of $57.00 being returned.

- But on those occasions when you lose, you will lose your stake of $57.00.

- Your fortune will grow, on average, by about 0.28% on each bet.

- Bets have been rounded down to the nearest multiple of $1.00.

- If you do not bet exactly $57.00, you should bet less than $57.00.

- The outcome of this bet is assumed to have no relationship to any other bet you make.

- The Kelly criterion is maximally aggressive — it seeks to increase capital at the maximum rate possible. Professional gamblers typically take a less aggressive approach, and generally will not bet more than about 2.5% of their bankroll on any wager. In this case that would be $25.00.

- A common strategy (see discussion below) is to wager half the Kelly amount, which in this case would be $28.00.

- If your estimated probability of 40.0% is too high, you will bet too much and lose over time. Make sure you are using a conservative (low) estimate.

- Please read the disclaimer below.

More Information

The BJ Math site used to contain a great collection of papers on Kelly betting, including the original Kelly Bell Technical System Journal paper. Unfortunately it is now defunct, and only contains adverts for an online casino. However, you can find much of the content through the Wayback Machine archive. The Internet Archive also contains a copy of Kelly's original paper which appeared as A New Interpretation of Information Rate, Bell System Technical Journal, Vol. 35, pp917-926, July 1956. (If this link breaks — as it has done several time since this page was written — try searching for the article title).

We based the above calculations on the description given in the book Taking Chances: Winning With Probability by John Haigh, which is an excellent introduction to the mathematics of probability. (Note that there is a misprint in the formula for approximating average growth rate on p359 (2nd edition) and the approximation also assumes that your advantage is small. There is a short list of corrections which can be found through John Haigh's web page).

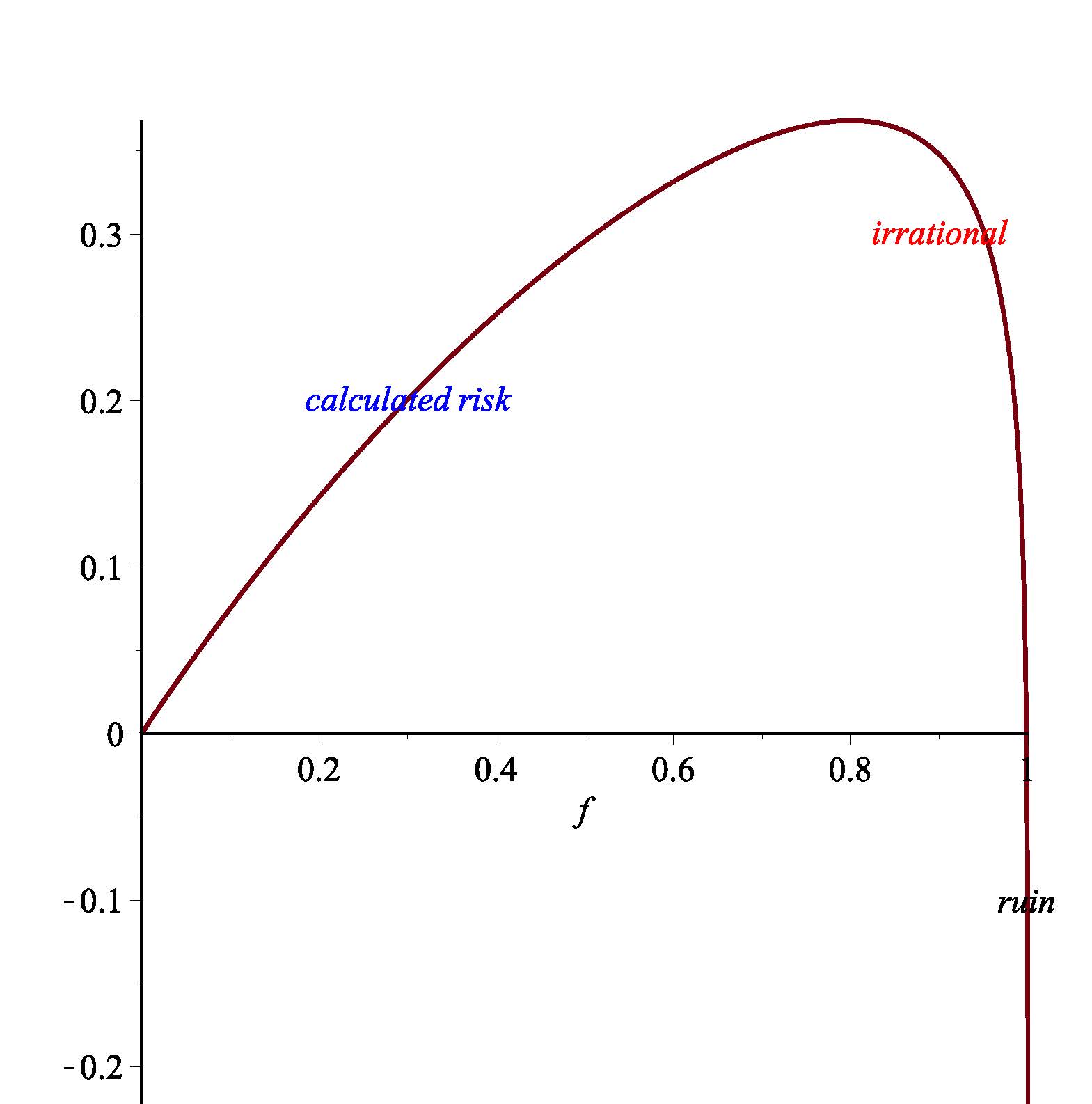

Note that although the Kelly Criterion provides an upper bound on the amount that should be risked, there are sound arguments for risking less. In particular, the Kelly fraction assumes an infinitely long sequence of wagers — but in the long run we are all dead. It can be shown that a Kelly bettor has a 1/3 chance of halving a bankroll before doubling it, and that you have a 1/n chance or reducing your bankroll to 1/n at some point in the future. For comparison, a “half kelly” bettor only has a 1/9 chance of halving their bankroll before doubling it. There's an interesting discussion of this (not aimed at a mathematical reader) in Part 4 of the book Fortune's Forumla which gives some of the history of the Kelly criterion, along with some of its notable successes and failures.

Jeffrey Ma was one of the members of the MIT Blackjack Team, a team which developed a system based on the Kelly criterion, card counting, and team play to beat casinos at Blackjack. He has written an interesting book The House Advantage, which examines what he learned about managing risk from playing blackjack. (He also covers some of the measures put in place by casinos to prevent the team winning!)

- Blackjack: Play Like The Pros: A Complete Guide to BLACKJACK, Including Card Counting, , Lyle Stuart, 2006.

- The Game Plan: How Casual Players Become Threats in No Limit Hold ’Em Tournaments, , Independently published, 2019.

- Blackbelt in Blackjack : Playing 21 as a Martial Art, , Cardoza, 2005.

- Beat the Dealer: A Winning Strategy for the Game of Twenty-One, , Vintage, 1966.

- High-Leverage Casino Gambling Systems: How to play like a minnow and score like a whale on your next casino visit, , CreateSpace Independent Publishing Platform, 2012.

- Gambling and War: Risk, Reward, and Chance in International Conflict, , Naval Institute Press, 2017.

- The World's Greatest Blackjack Book, , Crown, 1987.

- Math of Poker Basic: Pile Up Money and Professional Player: Essential Poker Math, , Independently published, 2020.

What Is The Kelly Criterion

See also

How does the Kelly criterion calculator work?

By entering your bankroll, the odds and your estimated probability of winning, the Kelly Criterion calculator will tell you how much you should wager on a certain event to maximise your value and profit.

Use the Kelly Criterion Calculator here

Kelly Betting System

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 |

According to the Kelly criterion, you should place a wager of approximately 1.18% of your account balance on this selection.

After applying the fractional Kelly value of 0.04, this adjusts to a wager of approximately 1.71% of your account balance.

Based on your account balance of $1,000, this equates to a wager of $11.76.

The expected value of this wager is approximately $11.76*[(0.68)(0.60) + (-1)(0.4)] = $0.09, which equates to a 0.80% return on the funds wagered.

The Kelly criterion returned a value of -0.0061.

After applying the fractional Kelly value of 0.0, this adjusts to -0.0061 of your account balance.

Because this number is below 0 you should not back the selection at the available odds.

What is the Kelly Criterion?

Kelly Betting Strategy

The Kelly Criterion is a method by which you can used your assessed probability of an event occurring in conjunction with the odds for the event and your bankroll, to work out how much to wager on the event to maximise your value. By inputting the odds, the probability of the event occurring and your betting balance, you will be able to determine the amount you should wager on the event. The fractional Kelly betting input is a way to change how aggressive or conservative you are with your wagering (1 being the standard and moving towards 0 the more conservative you wish to be with your wagering). Ultimately, the Kelly Criterion calculator, if you are accurate with your assessed probability should increase your value and profit over a long-term period.